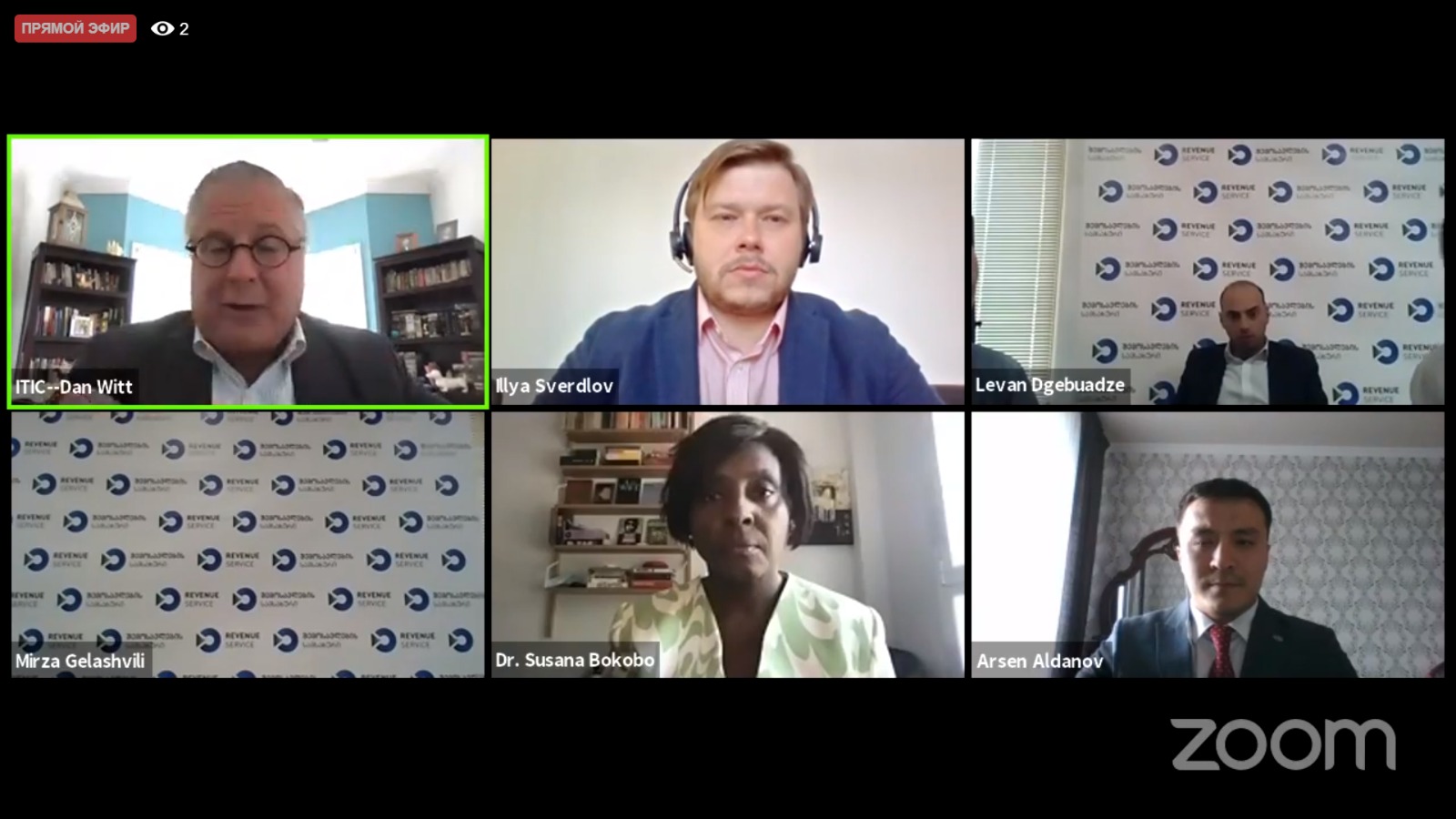

The COVID-19 pandemic and the subsequent lockdown have dealt a serious blow to the economy around the world. But it is the countries with economies in transition that have suffered the most. What tax and other fiscal measures can the authorities of the Eurasian countries and international financial institutions take to restore the economies of the Eurasian countries as soon as possible to resume the economic growth? These issues were discussed at StrategEast Live session on Fiscal measures to foster the economic recovery in Eurasia.

Arsen Aldanov, State Revenue Committee of the Ministry of Finance of Kazakhstan, Expert of the Strategic Development Department, talking about fiscal measures to support the economy undertaken by the government of Kazakhstan, first of all drew attention to the introduction of tax holidays to SMEs and a moratorium on any checks by the tax authorities.

Dr. Susana Bokobo, Global Senior Tax Expert, Professor, Author and Creative Entrepreneur spoke on the need to strike a balance between the needs of economic recovery and the ability of citizens to pay taxes which governments need to implement measures for economic recovery. Dr. Bocobo sees the solution of the problem in identifying priority areas of government support and focusing exclusively on key areas that differ from country to country.

Levan Dgebuadze and Mirza Gelashvili, Revenue Service of the Ministry of Finance of Georgia have emphasized that although the economy needs support during a pandemic, government spending has grown significantly. In order to maintain a balance between the interests of the state and business, priority areas of tax support were selected. In particular, the tourism sector, which is strategically important for Georgia, has received significant tax preferences. In particular, the tourism industry is exempted from property tax for the whole of 2020.

Illya Sverdlov, DLA Piper Ukraine, Partner, Head of Tax Practice, believes that fiscal measures already taken in Ukraine and in other countries of Eurasia are only the beginning of the fight against the consequences of lockdown. In two-three months governments and tax authorities will have to significantly review the tax support of the economy. Mr. Sverdlov supported the idea expressed by Dr. Bokobo that since the current pandemic is a unique challenge, to develop measures to support the economy, a new way of thinking and new, simple criteria for assessing the success of certain measures will be needed.

Panel moderator Daniel A. Witt, President of International Tax and Investment Center plans to systematize the experience of fiscal measures taken in Eurasia and use it as best practices in other regions.