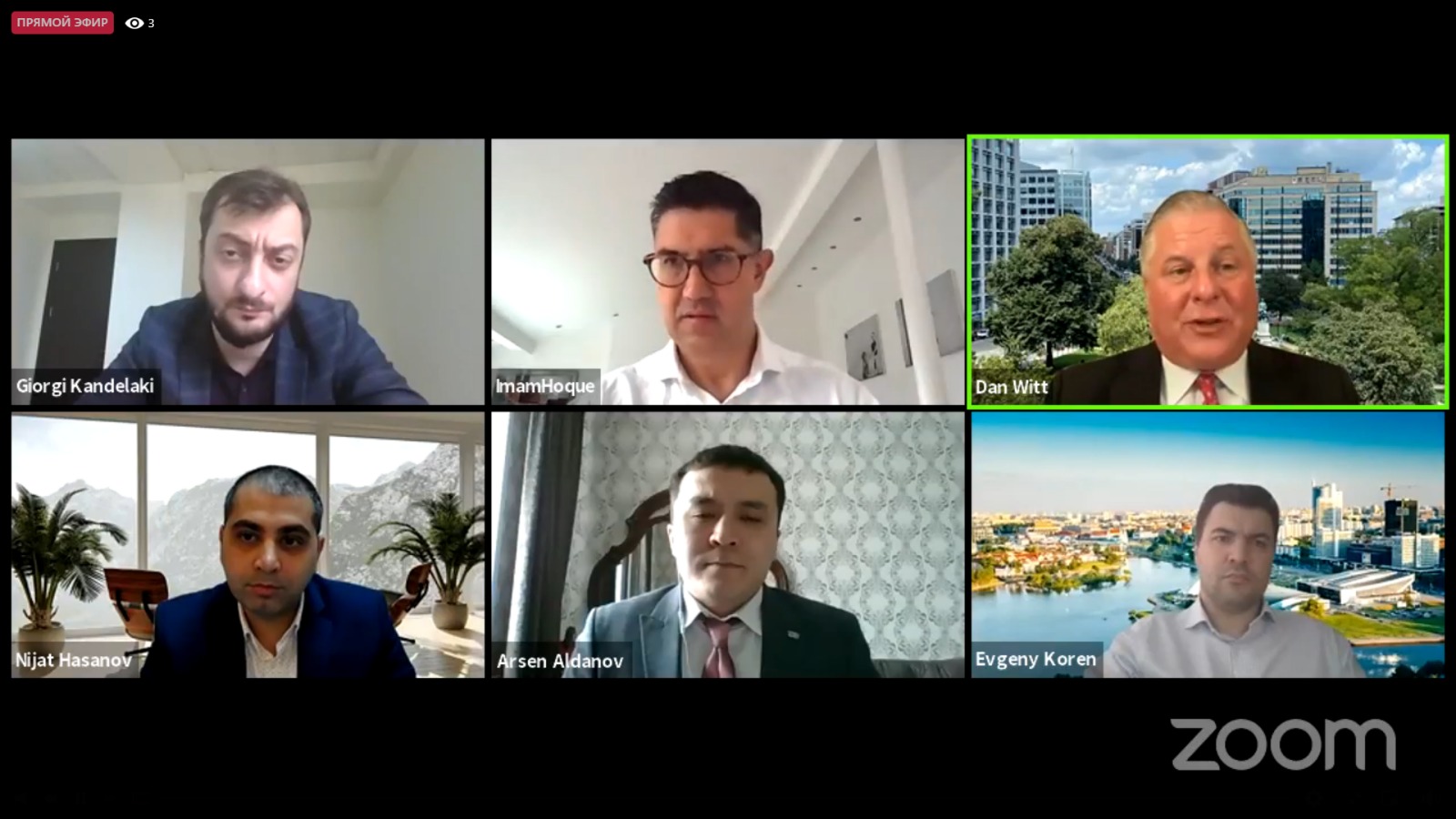

During the global economic turmoil tax authorities of Eurasian countries are at the forefront of the economic recovery in the region, as well as a key driver of the digital economy and an important part of sustainable growth. Many of the world’s most trusted digital transformation solutions for the tax system are developed by Microsoft, the world leader in these tasks. The panel discussion “Digital Solutions for Tax System”, organized by StrategEast and Microsoft, brought together the manufacturers of such solutions and their main beneficiaries – representatives of the tax departments of Eurasia.

For economies to recover from the COVID-19 pandemic, any country needs to solve three problems: grow economies, employment and state revenues. Digital solutions for tax systems are the very tool that leads to the solution of all these three tasks, – the moderator Daniel A. Witt, President at International Tax and Investment Center, began the discussion.

“Back in 2014, an electronic tax system was introduced in Kazakhstan,” says Arsen Aldanov, Chief Expert of the Strategic Development Division of the State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan. “Almost 100% of our tax services have been converted to electronic format. The new VAT refund system uses blockchain technology. But we have a new goal – the optimization of the reporting forms themselves. We plan to significantly reduce the number of reporting forms for taxes. And today Kazakhstan is recognized by international organizations as a country of the “leading group” in the digitalization of financial statements, and is assigned to the same group with such countries as Singapore, South Korea, Hong Kong and others.”

“If you ask the question, what does the tax system produce? The only thing we produce is the data. And the tax service’s duty to taxpayers is to make the best use of this data for the public good, says Giorgi Kandelaki, Deputy Head of Analytical Department at revenue service of Georgia. “We recently introduced a new electronic VAT refund system using learning machines and introduced new procedures for digital transformation. We also used Microsoft tools – to create risk modules and used open-source tools. It was really hard – not only to introduce software, but also to change the mindset of people. And today we can both defend the data and use it much better.”

“Technology provides new opportunities for the tax administration. And for us, the key is the integration of electronic systems of various ministries and departments from where we get the data, says Nijat Hasanov, Head of Information technologies division at the Digital Tax Administration Department, State Tax Service under the Ministry of Economy of the Republic of Azerbaijan. “Today 99% of tax returns are submitted in electronic format with an electronic signature integrated into the e-government system.”

“When we are dealing with the data, it is important to put it in context, until we do it is just a meaningless set of information,” explains Imam Hoque, Co-founder and CPO at Quantexa. “With the help of the contextual design intelligence, our systems do it. It helps to find criminal networks in the data set collected by the tax office and apply aggressive enforcement, and helps to highlight the straggling business and apply administrative action. In turn, such a system frees honest taxpayers from any suspicion. As a result, our systems identify three times more risks and save 70% of review time. We are now implementing similar systems all over the world from New Zealand to Belgium.”

“Microsoft has a good footprint and amount of projects around the world, including our region. And we are constantly working with presidents, ministers, governments – we help them in setting priorities in digital transformation correctly,” says Evgeny Koren, Country Manager at Microsoft Belarus. “Digital transformation is essential to sustaining tax agencies. And we provide various solutions for tax authorities in countries that are at different stages of digital transformation. Today, some of them need to implement cybersecurity, others need taxpayer experience, and still others need to implement tax management, which has become especially relevant during the COVID-19 pandemic, when very quick decisions are needed. In general, we have hundreds of solutions, including those developed by Quantexa and other companies based on our platform.”

The panel discussion “Digital Solutions for Tax System” was held online on March 24th, 2021, as a part of StrategEast.Live – a series of online panel discussions launched by StrategEast to continue the conversation on how technology can lead to an overall transformation in Eurasia. During these panels, the esteemed guests put forward ideas that facilitate the further development of a knowledge-driven economy in the region.