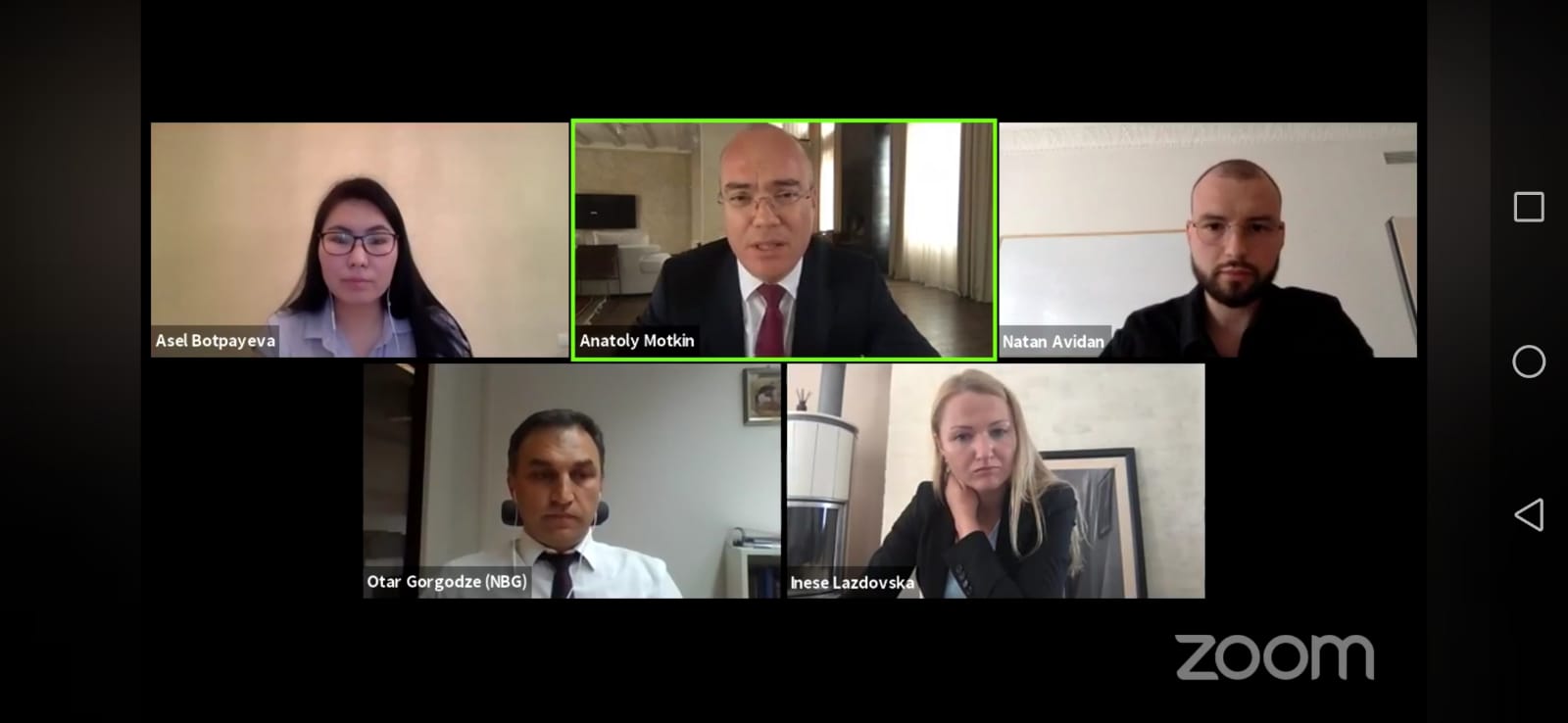

One of the industries that received significant acceleration as a result of the coronavirus pandemic and the subsequent lockdown was Fintech Industry. Digital transformation plans, which were designed for many financial companies for years, were implemented in a few months. How would the new post-coronavirus financial services industry in Eurasia look like? These issues were discussed on StrategEast Live session “Fintech industry in Eurasia”.

Inese Lazdovska, General Counsel, Mintos, talked on how pandemic and quarantine became the heyday of the fintech industry. Fintech industry promptly responded to new challenges, and not only fintech itself, but also regulators significantly accelerated their work, keeping pace with the development of the industry. According to Ms. Lazdovska, the most important thing for the fintech industry in the European Union is the universalization of legislation, so that fintech projects can become scalable. In particular, this relates to the regulation of remote client identification and anti-money laundering issues. Without a single regulation across the EU, scaling of projects is much more expensive.

Natan Avidan, Founder and CEO, Kernolab; Advisor, BigWallet; distinguishes Lithuania as a fintech hub for the whole Europe. Over 2000 fintech companies have already been working here. And the reason for such a success of Lithuania became flexible and communicative regulator. The Lithuanian regulator responds quickly, opens sandboxes for the fintech industry. But in order for Lithuanian success to be transferred to other countries of Eurasia, the question of scalability arises. It is important that other countries of Eurasia, such as Georgia, Uzbekistan and others, are allowed to operate on their territory with a Lithuanian license. And for this, universalization of legislation throughout the Eurasian space is necessary.

Otar Gorgodze, Head of Fintech & Suptech Development, National Bank of Georgia supported the idea of Mr. Avidan and said that the Georgian regulator is already opening sandboxes so that foreign companies can test their technologies in several jurisdictions simultaneously. At the same time, according to Mr. Gorgodze, fintech industry although has great potential, also carries certain risks, primarily related to money laundering. And only the right and very precise regulation allows to strike a balance between the prospects that the fintech industry carries and the risks that accompany it.

Asel Botpayeva, a consultant on the Fintech industry in Kyrgyz Republic, said that for her country, fintech projects have actually become vital for many residents. In Kyrgyzstan, 20% of residents live below the poverty line. Remittances comprise 30% of GDP. And for such people – both for local low-income people and deprived of access to the banking system, and for many guest workers who have left Kyrgyzstan to work abroad, only fintech projects can offer real solutions. However, according to Ms. Botpayeva, the fintech industry in Kyrgyzstan is at the very initial stage of development – regulatory legislation is only being developed, local companies do not have access to significant market financing, and as a result there is a demand for fintech services in the country, but no supply.

Answering a question by the panel moderator Anatoly Motkin, President of StrategEast, on the potential role that international institutions could play in the development of the Kyrgyz fintech, Ms. Botpayeva singled out as a benchmark the Kyrgyz UN project, which uses a cashless payment system, as a microlanding for the Kyrgyz market, but she noted that in the long term, private investors should come to replace international institutions as a driving force for the development of fintech in Kyrgyzstan.